The road to a new DEX Token Economy

Setting the foundation for decentralized trading

It has been a few years now since the world of DeFi came to light. It was first enabled by smart contracts deployed on the Ethereum chain. Large protocols such as Uniswap grew at a fascinating rate, paving the way for an incredibly fast and innovative new financial sector.

In terms of DEXes, it actually all started with the fact that two tokens could be placed in a pool at a 50/50 ratio, allowing trading of those two tokens. The functionality is usually called Automated Market Making (AMM). An AMM works similar to an order book on an exchange with different trading pairs, except that the user does not need a counterparty to trade, but interacts directly with the smart contract. Thus, trades on a DEX are executed directly with the smart contract. The prices of the tokens are determined by a mathematical formula that is stored in the smart contract. For traders, it was thus possible for the first time to trade without intermediaries or a centralized platform.

For liquidity providers, this also created a very lucrative business case, providing liquidity and receiving a share of the generated trading fees. This idea was revolutionary, because for the first time it was possible to provide the liquidity needed for trading in a decentralized way. Anyone could now provide liquidity and earn money from the trading fees. This was a business that was traditionally only possible for so-called market makers.

Bootstrapping Liquidity with new Incentive Schemes

Since launching on Ethereum, DeFi has spread to more chains and into more ecosystems. However, for a young ecosystem or a new protocol, the difficulty is attracting initial liquidity. If there is no liquidity on a platform, then no one can trade, and conversely, no one provides liquidity if there are no traders. DEXes in particular need a large amount of liquidity to keep slippage low. For this reason, new types of DEXes have come up with interesting incentive models in addition to the actual fee cut rewards to bring initial liquidity to the platform and be competitive with the already established protocols in the long run.

This is how new DEXes such as SushiSwap and Pancakeswap were created. What makes these DEXes special is that they pay out a reward token in addition to the LP trading fee cut. Thus, it was made possible to stake/farm LP tokens and receive a reward in the form of a reward token. Since the Reward APR is in direct proportion to the pool size, especially small pools can be strongly bootstrapped, since the APRs are very high. If the addition of liquidity is purely tied to fee cut, it can still be unattractive to enter as a liquidity provider at the beginning, especially with very volatile tokens. Liquidity pools that are too small usually cannot generate a high trading volume and the return might be too low with regard to possible impermanent losses. This problem has been elegantly solved through new inventive reward token models, which especially reward early liquidity providers with high APRs.

The reward token is minted natively in a smart contract of the platform. DEXes have developed different strategies for this: One strategy is to mint a defined amount of tokens once and then distribute them over time. The alternative is to set a certain minting rate, which is then distributed to the farms/pools every second. There is probably no good or bad strategy - in the end it depends on the whole concept of the DEX. Much more important than the mint strategy, is the utility of the reward token, which creates the value.

Now, with the help of a reward token, the problem of bringing initial liquidity to a new DEX for trading has been solved. However, it has been shown that it can sometimes be difficult for protocols to keep the price of their reward token stable over the long term, as the minting rate is often constant but the growth of the platform varies. Liquidity providers who are put off by this volatility, often feel compelled to exchange the reward token for a more stable asset.

To keep the reward token as stable as possible from the supply, burning mechanisms have been developed to remove these tokens from the market. It is also critical to add value to the reward token in the form of special features and utility. For example, one feature is the ability to participate in the governance of a DEX or to allow reward token holders to participate in certain revenue streams from the DEX.

These new types of DEXes (i.e. fee share plus reward for LP) have achieved a massive success rally over the past years, managing to accumulate tens of billions of TVL on the protocols. Success stories like Pancakeswap show how this strategy alone can be successful in the long run.

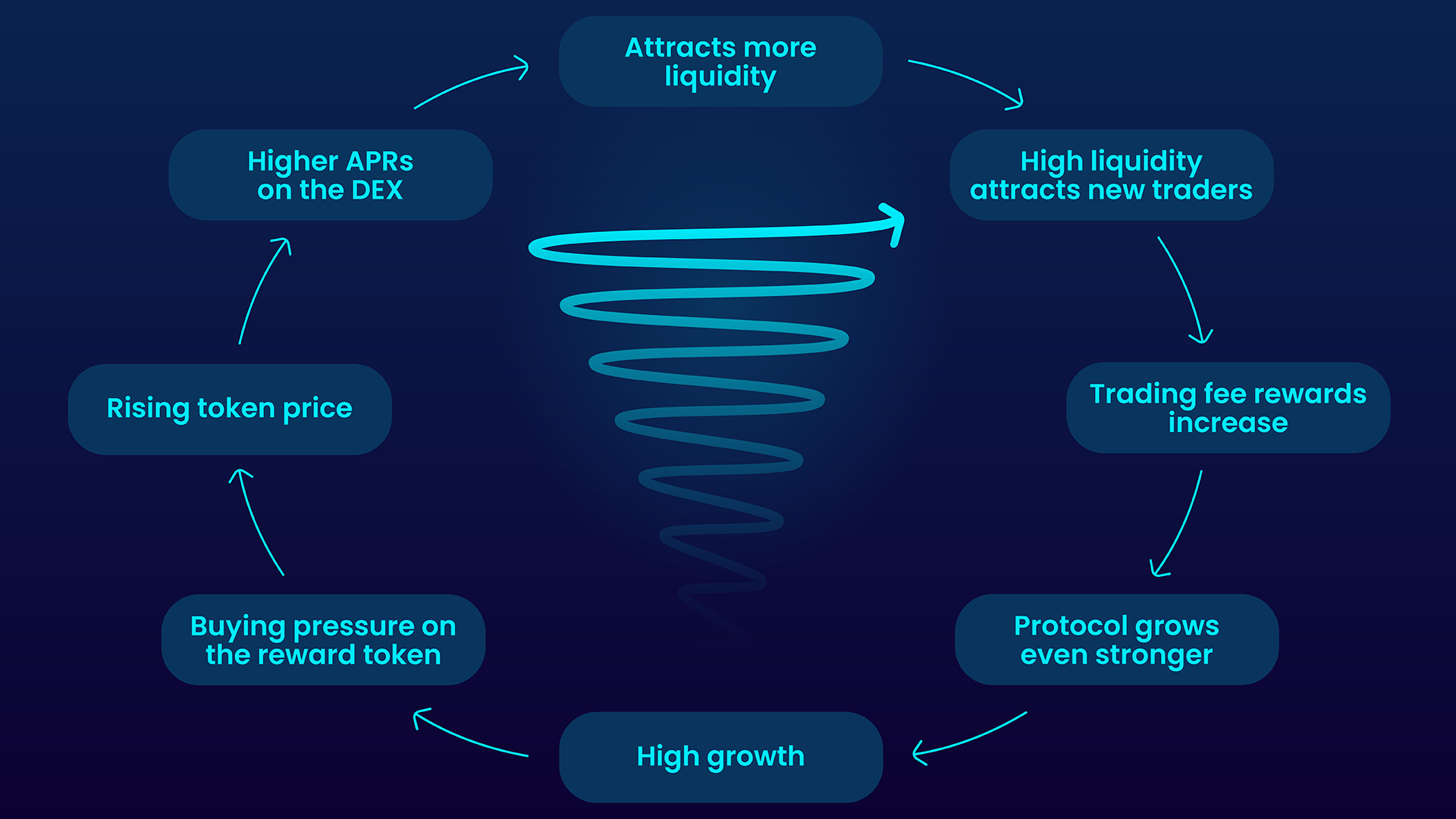

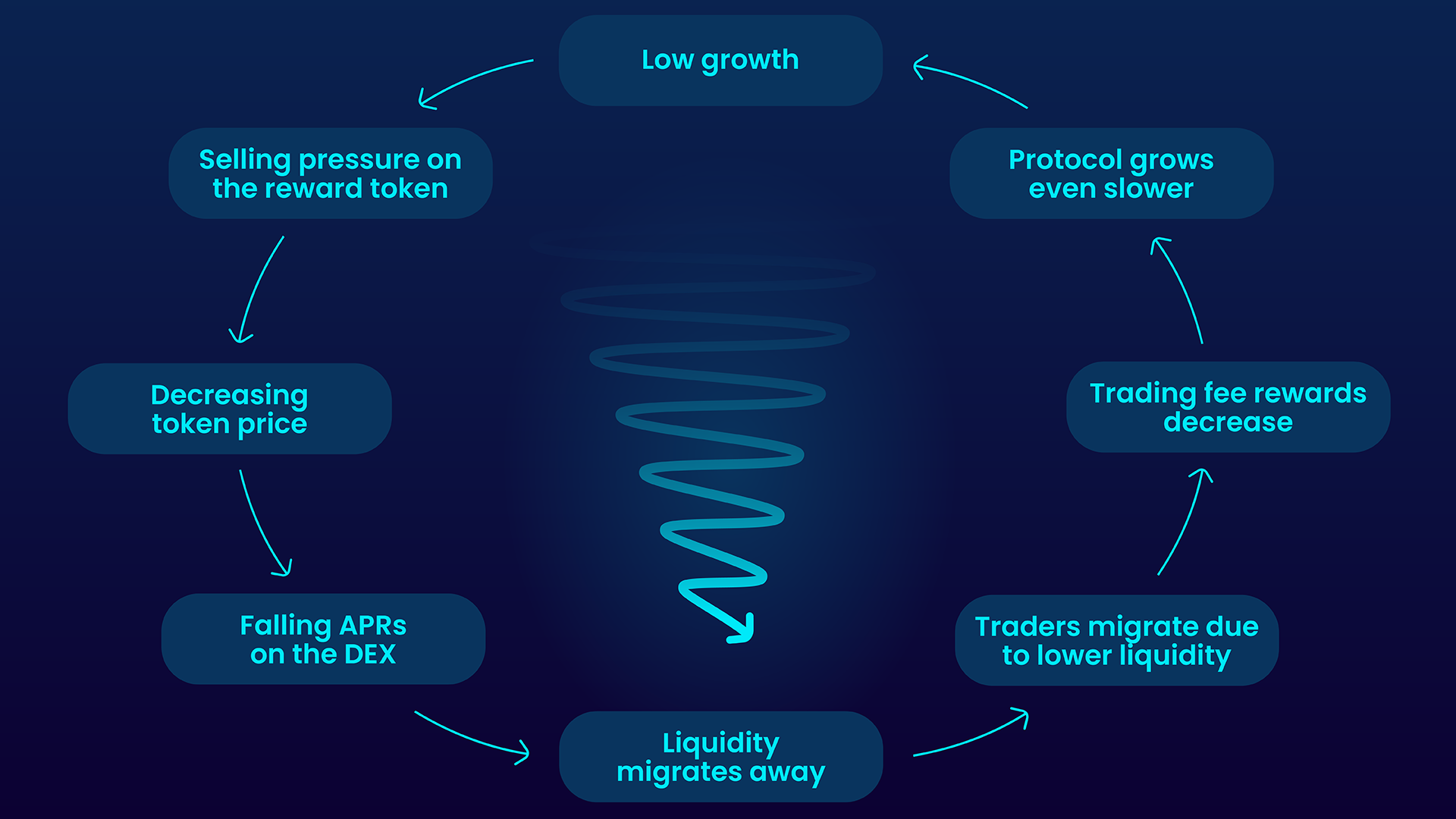

However, the downside of this model is the high volatility of the reward token. A constant payout ratio of the reward token means that the growth of the platform must also be linear so that the token price remains roughly the same. If the protocol and the expectations of the liquidity providers grow much faster, then the price of the tokens shoots up and there is a positive upwards spiral for the platform.

However, if the protocol growth slows down at times and confidence in the token wanes, then the token price can quickly come under pressure, which can lead to a downward spiral for the platform.

These feedback spirals can make the protocol grow very fast, but also destabilize it quickly. The reward token without further mechanisms is therefore extremely volatile with high potential, but also high risk.

ShimmerSea a new DEX with a sustainable Token Economy

ShimmerSea is a DEX designed from day one to generate sustainable value for traders, liquidity providers and Magic-LUM holders!

For this purpose, the original DEX models mentioned above have been further developed and combined with the latest strategies from the DeFi sector. Additionally, mechanisms with innovative smart contracts have been developed to make ShimmerSea's token economy more robust and resilient. This makes ShimmerSea unique in its technology and strategy.

ShimmerSea is the result of intensive research and an experienced team of developers bringing the innovative models to life in code.

In order to realize the vision of ShimmerSea, a new token model was developed, which is designed with two tokens. This model can not be compared to but takes inspiration from the balancing mechanisms that bonds and stocks have with each other in the traditional financial market. A stock represents a fixed share of a company, which additionally entitles the owner to voting rights and possible dividend distributions from the company. A bond, on the other hand, is not a fixed share in a company, but a security that grants the owner a repayment claim including defined interest from the company. These two principles of having independent elements that are traditionally inversely correlated inspired ShimmerSea’s token economics. The result is a dual token model with $LUM and $Magic LUM, in which the tokens support each other.

LUM is our reward token, which is traditionally minted continuously according to an original DEX principle. In an isolated perspective it is a more volatile and risky token.

Magic LUM is the governance token and, unlike LUM, is limited by the total amount of 1 million tokens. Magic LUM has several features that give the token resilience and influence.

These two tokens are related to each other through a specially developed smart contract that we call “Booster”. Through the Booster, Magic LUM stabilizes the LUM token, preventing a possible downward spiral as described in the previous chapter.

Building on the basic ideas of the Dual Token System, other strategies have been integrated into ShimmerSea that give our DEX independence and sustainability in the long run. One of these strategies is to build up Protocol Owned Liquidity (POL). This liquidity is held in a treasury, which is overseen by the ShimmerSeaDAO. The growing treasury gives the DEX an intrinsic value that goes beyond mere functionality.

The innovative thing about the ShimmerSea token economy, however, is not the pure double token system alone, but the way the two tokens influence each other through the Booster. The result is a DEX that steadily gains robustness and independence. With these features, ShimmerSea is designed to establish itself for the long term and generate sustainable value for the community.

Powered by BlueLabs

Powered by BlueLabs